Quick Summary

POS systems cost anywhere from $40 to $20000+ depending on your business size & needs. Small businesses typically spend $3000-$5000 on initial setup & $40-$200 monthly for software. Restaurant POS systems cost more ($5000-$10000) due to specialized hardware. iPad POS systems offer cheaper alternatives starting at $600-$1200 for hardware plus $40-$100 monthly subscription fees. Major costs include hardware (terminals, printers, cash drawers), software subscription fees, installation, training & payment processing fees. This guide helps you understand all POS costs to avoid surprises.

“The biggest mistake I see small business owners make with POS systems is focusing only on upfront price tag. The real cost comes from ongoing fees, updates & support that add up over time.” – Maria Chen, Retail Technology Consultant

Understanding POS System Costs

What is a POS System?

A POS (Point of Sale) system is where your customers pay for products or services. In the old days, it was just a cash register. Now, it’s a mix of hardware & software that does more than just take payments.

Modern POS systems can:

- Track inventory

- Manage employees

- Create reports

- Handle customer data

- Process different payment types

For a small business, picking the right POS system can be tough. There are so many options! And costs vary a lot.

Types of POS Systems and Their Costs

POS systems come in different forms. Let’s look at the main types:

Traditional POS Systems

These are the old-school, fixed systems. They use specialized hardware and local servers.

Cost breakdown:

- Hardware: $2,000-$5,000 per station

- Software: $1,000-$2,500 one-time fee

- Installation: $500-$1,500

- Training: $200-$500

- Yearly maintenance: $300-$500

These systems cost more upfront. But they might be cheaper in the long run since you don’t pay monthly fees.

Cloud-Based POS Systems

Cloud POS systems are newer. They store data online instead of on local servers. You can access your data from anywhere with internet.

Cost breakdown:

- Hardware: $600-$1,200 per station

- Software: $40-$300 monthly fee

- Installation: $0-$500

- Training: Often included

- Payment processing: 1.4%-3.5% per transaction

Cloud systems have lower upfront costs. But monthly fees add up over time.

Mobile/iPad POS Systems

These are super popular now. They turn tablets or smartphones into POS systems.

Cost breakdown:

- Hardware (iPad/tablet): $300-$500

- Stand and card reader: $100-$200

- Receipt printer: $200-$300

- Cash drawer: $100-$150

- Software subscription: $40-$100 monthly

- Payment processing: 1.4-3.5% per transaction

iPad POS systems are great for small businesses that want something affordable and easy to use.

POS Hardware Costs

Let’s break down how much each piece of POS hardware costs:

| Hardware Item | Price Range | Notes |

|---|---|---|

| POS Terminal/Computer | $300-$2,000 | Basic PC to specialized terminal |

| Tablet/iPad | $300-$900 | Depends on model and specs |

| Card Reader | $25-$500 | Basic magstripe to full EMV/NFC |

| Receipt Printer | $200-$500 | Thermal vs. impact printers |

| Barcode Scanner | $100-$500 | Handheld vs. countertop |

| Cash Drawer | $100-$300 | Manual vs. automatic |

| Customer Display | $200-$300 | For showing order details |

| Kitchen Printer | $300-$500 | For restaurant orders |

| Scale | $200-$800 | For weighing products |

Most small businesses need at least:

- 1-2 terminals/tablets

- Card readers

- Receipt printers

- Cash drawers

For a restaurant POS system, you’ll also need kitchen printers and maybe tablets for servers.

POS Software Pricing Models

There are three main ways companies sell POS software:

1. One-Time Purchase

- Pay once, own forever

- Cost: $500-$3,000

- Usually needs yearly updates ($100-$300)

- Limited support after first year

- Best for: Businesses that hate monthly bills

2. Subscription-Based (SaaS)

- Monthly or yearly fee

- Cost: $30-$300 per month per terminal

- Includes updates and support

- Scales with your business

- Best for: Most small businesses

3. Free POS Software

- No upfront cost

- Makes money from payment processing

- Higher transaction fees (2-3.5%)

- Limited features

- Best for: Very small businesses just starting out

“When evaluating POS costs, look at total cost of ownership over 3-5 years. The cheapest option upfront can end up being the most expensive long-term.” – James Wilson, Small Business Technology Advisor

Industry-Specific POS Costs

Different industries have different POS needs and costs.

Restaurant POS Costs

Restaurants need specialized features in POS system like:

- Table management

- Split checks

- Kitchen display systems

- Online ordering integration

- Ingredient tracking

A complete restaurant POS system costs $5,000-$10,000 upfront for hardware plus $100-$300 monthly for software.

A food ordering system integration will add another $40-$150 per month to your costs, but can increase sales by 20-30% according to industry data.

Retail POS Costs

Retail stores need:

- Inventory management

- Barcode scanning

- Customer loyalty programs

A complete retail POS costs $2,000-$5,000 for hardware plus $40-$200 monthly for software.

Bar POS Costs

Bars need:

- Tab management

- Quick payment processing

- Inventory by weight/volume

A bar POS system typically costs $3,000-$7,000 for hardware plus $100-$200 monthly for software.

Implementation and Running Costs

The sticker price isn’t the only cost. You need to think about:

Installation Costs

- Professional installation: $300-$1,000

- DIY installation: Free but takes time

- Data migration: $100-$500

Training Costs

- Staff training: $200-$500

- Online training: Often free with subscription

- Ongoing training for new staff: Time cost

Support and Maintenance

- Basic support: Usually included

- Premium support: $20-$100 monthly

- Hardware maintenance: 10-15% of hardware cost yearly

Hidden Costs

- Software updates (for one-time purchases): $100-$300 yearly

- Additional users: $20-$50 per user monthly

- Added features: $10-$100 monthly per feature

- Integration with other software: $15-$200 monthly

Real-Life Example: Sarah’s Café

Sarah opened a small café last year. She chose a cloud-based POS system. Here’s what she spent:

- 2 iPad tablets: $800

- 2 tablet stands with card readers: $300

- 2 receipt printers: $400

- 1 cash drawer: $100

- Kitchen printer: $300

- Initial setup: $1,900

- Monthly software fee: $100

- Payment processing fees: ~$500 monthly (on $20,000 sales)

Total first-year cost: $9,900

Sarah says: “I was shocked by the payment processing fees. That’s where they get you! Shop around for the best rates.”

Stop Overpaying For Your Restaurant POS Today!

Note: Foodship partnered with many provider with zero eftpos cost to merchant.

Making the Right POS Investment

Payment Processing Fees

This is where many business owners lose money! Payment processing fees can be confusing.

Most POS companies charge:

- A percentage of each sale (1.4-2.5%)

- A flat fee per transaction ($0.10-$0.30)

Industry Secret: You can negotiate processing rates, especially if you have high sales volume. Many businesses save thousands by shopping around.

QR Code Ordering Systems Cost

A QR code ordering system has become popular since COVID-19. These systems let customers scan a QR code to see a menu and order without a server.

Costs include:

- Setup fee: $300-$1,000

- Monthly fee: $40-$200

- Integration with POS: $0-$500

- Custom QR code designs: $0-$100

While adding a QR code ordering system costs extra, restaurants report 15-25% higher average order values when customers order this way!

Small Business Budget Options

If you’re on a tight budget, here are some affordable POS options:

Starter Package

- Mobile card reader + free app

- Your own smartphone or tablet

- Cloud-based software

- Cost: $0-$500 upfront + processing fees

Basic Package

- Tablet with stand

- Card reader

- Receipt printer

- Basic software

- Cost: $600-$1,200 upfront + $40-$100 monthly

DIY Package

- Buy refurbished hardware

- Use open-source POS software

- Set up yourself

- Cost: $500-$1,500 upfront

“For new businesses, I recommend starting with a simple system and upgrading as you grow. Too many features can overwhelm staff and lead to mistakes.” – David Lopez, Restaurant Consultant

Controversial Opinion: Free POS Systems Are Rarely Free

Many companies offer “free” POS systems. But here’s the truth: they make money by charging higher payment processing fees.

Let’s compare:

- “Free” POS: 2% + $0.30 per transaction

- Paid POS: 1.4% + $0.10 per transaction + $40 monthly fee

The “free” option costs more per year!

How to Save Money on POS Costs

Here are some insider tips to save money:

- Buy hardware separately – POS companies mark up hardware by 10-30%

- Negotiate processing rates – Even 0.2% less can save thousands

- Start with basic features – Add more as needed

- Look for bundle discounts – Many companies offer deals for buying software and hardware together

- Consider seasonal or annual payment plans – Some offer 10-20% discounts for annual payment

Choosing the Right POS System for Your Budget

Follow these steps to find a good match:

- List must-have features vs. nice-to-have features

- Set a budget for upfront costs and monthly fees

- Get quotes from at least 3 vendors

- Calculate total cost of ownership for 3 years

- Ask for trials or demos before buying (Checkout this POS Buying Guide)

Case Study: Mike’s Corner Store

Mike needed a simple POS for his convenience store. He compared options:

Option 1: Premium System

- Upfront cost: $3,500

- Monthly fee: $150

- Processing rate: 1.6% + $0.10

Option 2: Mid-range System

- Upfront cost: $1,800

- Monthly fee: $100

- Processing rate: 1.5% + $0.10

Option 3: Budget System

- Upfront cost: $800

- Monthly fee: $40

- Processing rate: 1.4% + $0.15

Mike chose Option 3 because it had the features he needed with reasonable long-term costs.

Future-Proofing Your POS Investment

Technology changes fast. Here’s how to make sure your POS isn’t outdated soon:

- Pick cloud-based systems that update automatically

- Choose companies with good innovation track records

- Make sure your system can integrate with other software

- Avoid long contracts (over 2 years)

- Plan for hardware upgrades every 3-5 years

Common POS System Pitfalls to Avoid

Many business owners make these mistakes:

- Buying based on price alone – Cheapest upfront isn’t always cheapest long-term

- Ignoring payment processing rates – Often your biggest expense

- Getting locked into long contracts – Business needs change

- Choosing systems that don’t scale – You’ll outgrow them

- Skipping training – Poorly trained staff won’t use all features

When to Upgrade Your POS System

Signs it’s time for a new system:

- Staff complains about speed

- You can’t get reports you need

- Hardware fails frequently

- Customer checkout takes too long

- You’ve outgrown your features

Most businesses should evaluate their POS needs every 2-3 years.

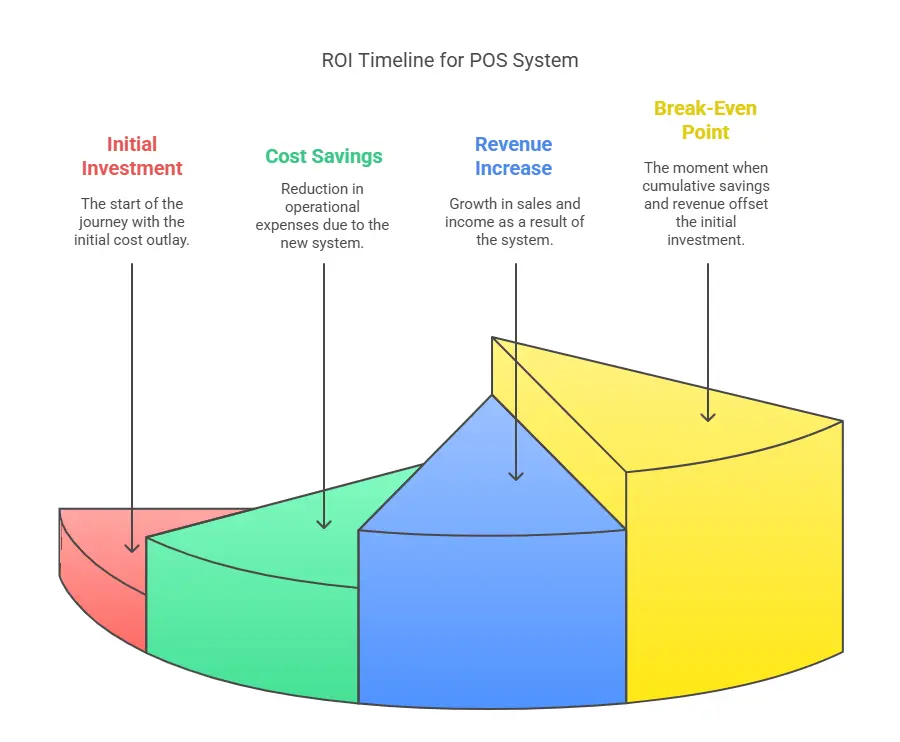

Final Thoughts: Calculating ROI on POS Investment

A good POS system isn’t just an expense—it’s an investment. Here’s how to calculate ROI:

- Time saved (hourly rate × hours saved)

- Inventory shrinkage reduction

- Higher average sales from upselling features

- Faster checkout = more customers served

- Better reporting = smarter business decisions

Studies show that modern POS systems can:

- Reduce labor costs by 10-15%

- Decrease inventory shrinkage by 25%

- Increase average ticket size by 5-10%

For a business doing $500,000 yearly, that could mean $50,000+ in additional profit!

“The right POS system pays for itself. I’ve seen businesses transform their operations and profitability just by having better data from their POS.” – Samantha Wright, Retail Business Coach

Conclusion

POS systems cost anywhere from $40 to $20,000 depending on your needs. Most small businesses spend $3,000-$5,000 upfront plus $40-$200 monthly.

Remember to consider:

- Hardware costs

- Software subscription fees

- Installation and training

- Payment processing rates

- Ongoing support

- Hidden costs

The best POS system isn’t always the cheapest or the most expensive—it’s the one that fits your specific business needs and budget.

Take your time researching options. Ask other business owners what they use. And always try before you buy!

FAQs About POS Costs

Q: How much should a restaurant expect to pay for a complete POS system?

A: $1,000-$5,000 upfront plus $40-$300 monthly for a full-featured restaurant POS system.

Q: Are there monthly fees for POS systems?

A: Most modern systems charge monthly fees ($40-$300), but some offer one-time purchase options.

Q: What’s the difference in cost between traditional and iPad POS systems?

A: iPad systems typically cost $600-$1,200 per station, while traditional systems cost $2,000-$5,000 per station.

Q: Can I use my existing hardware with a new POS software?

A: Sometimes, but compatibility varies. Always check with the provider first.