Summary

Getting a POS machine isn’t rocket science, but most people do it wrong. This guide shows you exactly how to get pos machine from banks, online stores, and payment companies. You’ll learn secret tricks that banks don’t tell you, real costs (spoiler: it’s not what they advertise), and why 70% of small businesses overpay for their first POS system. We cover everything from where to buy pos machine to how to apply for pos machine without getting rejected. Plus, we’ll expose the dirty secrets of POS pricing that nobody talks about.

Why Most People Get Ripped Off When They Buy POS Machine

Let me tell you something crazy. Last week, I met a restaurant owner who paid $1,500 for a basic POS system. The same system? You can get it for $199 online. That’s not a typo. That’s the POS industry for you.

Here’s the thing nobody tells you: Getting a POS machine is like buying a car. The sticker price means nothing. The real cost comes from fees, monthly charges, and those sneaky transaction costs that add up fast.

“Most small business owners lose $2,000-$5,000 in the first year just because they don’t know how POS pricing really works.” – Sarah Chen, Small Business Payment Consultant

The Shocking Truth About POS Machine Costs

| What They Tell You | Reality | Hidden Costs |

|---|---|---|

| “Free POS machine!” | $0 upfront | $50/month for 36 months |

| “Low 1.9% rates” | 1.9% advertised | 2.8% after all fees |

| “No setup fees” | Free setup | $99 “activation fee” |

This is why you need to know how to get a pos machine the smart way.

How to Get POS Machine from Bank: The Good, Bad, and Ugly

Banks love to sell POS machines. Why? Because they make crazy money from it. But here’s what they won’t tell you.

Why Banks Push POS Machines So Hard

Banks make money three ways:

- Selling you the machine (markup: 200-400%)

- Monthly fees ($30-80 per month)

- Transaction fees (they take a cut of every sale)

Real example: My friend Jake got a POS machine from his local bank. They said “only $49/month.” After one year, he calculated his total cost: $2,847. The same system online? $399 total.

The Bank POS Application Process (What Really Happens)

When you apply for pos machine at a bank, here’s the real process:

Week 1: You fill out forms. Lots of forms. Week 2: They check your credit (this part they don’t always mention upfront) Week 3: They call for “additional documentation” Week 4: Finally approved, but with higher rates than advertised

“Banks treat POS applications like loan applications. Your credit score affects everything – rates, fees, even if you get approved.” – Marcus Rodriguez, Former Bank Payment Specialist

Secret Bank POS Trick

Here’s something controversial: Banks often give better deals to customers who threaten to leave. I know a guy who got his monthly fees cut in half just by saying he found a cheaper option online.

The script that works: “I love banking here, but I found the same POS system for half the price online. Can you match it?”

Where to Buy POS System: Your Real Options

Let’s talk about where to buy pos machine without getting scammed.

Option 1: Online Retailers (Best Value)

Pros: Cheapest prices, no pressure sales Cons: Setup might be tricky, limited support

Best places:

- Amazon Business (great return policy)

- PayPal store (if you use PayPal already)

Option 2: Direct from Payment Companies

Companies like Square, Stripe, and others want your transaction fees. So they practically give away the hardware.

The catch: You’re locked into their payment processing. But honestly? Their rates are usually better than banks anyway.

Option 3: Local Dealers (Most Expensive)

Local dealers charge the most. But they give the best hand-holding support. If you’re not tech-savvy, this might be worth it.

Average markup: 300-500% over online prices

How Can I Get POS Machine Without Breaking the Bank

Here’s my controversial opinion: Most businesses don’t need expensive POS systems. A tablet with a card reader works for 80% of small businesses.

The $50 vs $500 POS Reality Check

$50 solution:

- iPad + Card reader

- Takes all payments

- Basic reports

- Perfect for coffee shops, small retail

$500 solution:

- Professional terminal

- Advanced inventory

- Employee management

- Better for restaurants, large retail

Truth bomb: Most small businesses buy the $500 solution when the $50 one would work fine.

Secret Shopping Strategy

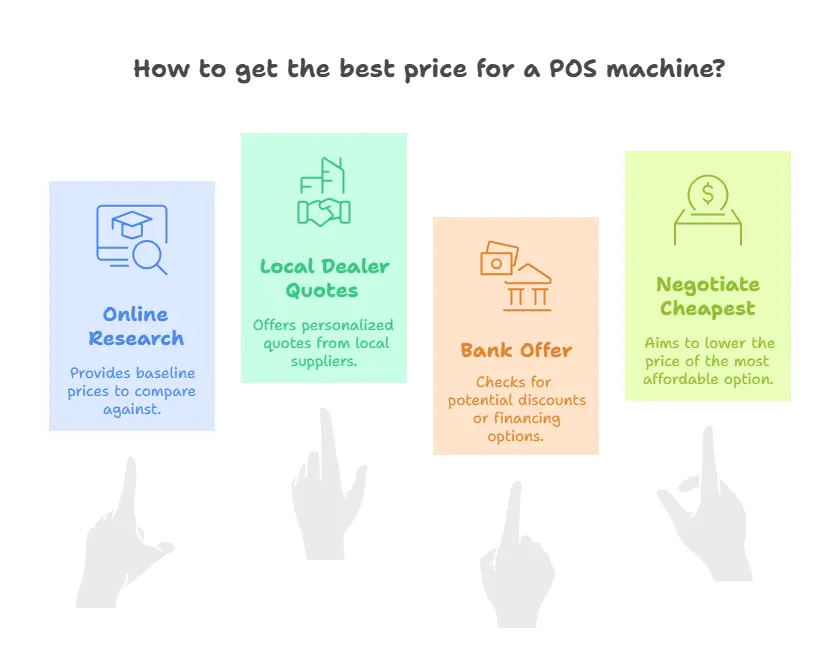

Want to know how to get pos machine for the best price? Shop like this:

- Start online – get baseline prices

- Call three local dealers – get quotes

- Contact your bank – see their offer

- Go back to the cheapest option – negotiate even lower

Apply for POS Machine: What They Don’t Tell You

The application process is designed to confuse you. Here’s what really matters.

What Kills Your Application

- Bad credit (under 650 is tough)

- New business (under 6 months is red flag)

- High-risk industry (bars, clubs, adult businesses)

- No bank account history (they want 6+ months)

The Application Hack Nobody Talks About

Here’s a secret: Apply through payment processors, not banks. They approve almost everyone because they make money on transactions, not credit.

Approval rates:

- Banks: 60-70%

- Payment processors: 85-95%

How to Get a POS System That Actually Works for Your Business

Most people choose POS systems like they choose phones – by what looks cool. Wrong approach.

The Restaurant Reality Check

Restaurants need different features in POS than retail stores. Obvious, right? But 40% of restaurants buy retail POS systems and wonder why they struggle.

Restaurant must-haves:

- Table management

- Kitchen display integration

- Split billing

- Tip management

Fun fact: Restaurants using proper restaurant pos system serve customers 23% faster than those using basic retail systems.

The Retail Truth

Retail stores care about inventory. Period. Everything else is secondary.

Retail priorities:

- Inventory tracking

- Barcode scanning

- Purchase orders

- Sales reports

Modern Restaurant Game-Changer

Here’s something cool happening now: QR code ordering system is changing everything. Customers scan, order, and pay without servers. Labor costs drop 30-40%.

Some smart restaurant owners combine traditional POS with QR ordering. Best of both worlds.

The Dirty Secrets of POS Pricing

Ready for some controversial truth? POS companies make most money from fees, not hardware. That’s why they “give away” free machines.

The Fee Structure Nobody Explains

Processing fees: 1.6% – 3% per transaction Monthly fees: $20 – $100 Statement fees: $10 – $25 Chargeback fees: $15 – $50 per dispute Early termination: $200 – $500

“The POS industry thrives on confusion. The more complex they make pricing, the more money they make.” – David Park, Payment Industry Insider

Where Can I Get POS Machine with Honest Pricing

After years in this industry, I found only a few companies with transparent pricing:

The Honest Players

- Square: What you see is what you pay

- PayPal Here: No monthly fees for basic plan

- Stripe Terminal: Developer-friendly, fair pricing

- Foodship: New player with restaurant focus (transparent fees, no hidden costs)

Stop Overpaying For Your Restaurant POS Today!

How Do I Get POS Machine That Grows With My Business

This is where most people mess up. They buy for today, not tomorrow.

Scalability Questions to Ask

- Can I add more registers easily?

- Does it work with multiple locations?

- Can I upgrade features without changing hardware?

- What happens if I outgrow this system?

The Multi-Location Trap

Single-location POS systems are cheap. Multi-location systems cost 5-10x more. Plan ahead or pay later.

Real example: Tony had 3 pizza shops. His single-location POS worked great for shop #1. Adding shops #2 and #3? Complete system replacement. Cost: $5,000.

Payment Processing: The Hidden Money Maker

Here’s what POS companies don’t want you to know: They make more money from processing your payments than selling you hardware.

Processing Rate Breakdown

Interchange fees which goes to card companies: 1.8% to 2.2%

Processor markup: 0.5% to 1.5%

Your total cost: 2.3% to 3.7%

The Volume Discount Lie

They say “process more, pay less.” Sometimes true, sometimes not.

Volume tiers:

- $0 – $10k/month: 3%

- $10k – $50k/month: 2.2%

- $50k+ /month: 1.6%

Reality check: You need to process $50k monthly to get meaningful discounts. Most small businesses never reach that.

Choosing the Right POS for Different Business Types

Coffee Shops and Quick Service

Coffee shops need speed. Period. Average transaction time should be under 30 seconds.

Must-have features:

- Fast payment processing

- Simple menu setup

- Quick modifier buttons (extra shot, almond milk, etc.)

- Mobile payment acceptance

Don’t waste money on:

- Complex inventory management

- Employee scheduling

- Advanced reporting

Full-Service Restaurants

Restaurants are complex. Your POS should handle that complexity without making staff crazy.

- Table management

- Split checks

- Kitchen integration

- Tip pooling

- Food ordering system integration

Modern addition: Many restaurants now use QR code ordering system alongside traditional POS. Customers order via QR codes, kitchen gets orders through POS system.

Retail Stores

Retail is all about inventory. If your POS can’t track inventory properly, find a different one.

Core needs:

- Barcode scanning

- Inventory alerts

- Purchase order management

- Multi-location inventory sync

Where to Buy a POS System: Negotiation Tactics

Most people pay full price for POS systems. Here’s how to pay less.

The Negotiation Game Plan

- Get three quotes minimum

- Ask for their “best price” upfront

- Mention competitor prices

- Bundle services for discounts

- Pay annually instead of monthly

Words That Get Discounts

“What’s your best price for cash payment?” “I am comparing three vendors & what makes you special?” “I am ready to sign today if price is right.”

These phrases trigger sales mode. Use them.

The End-of-Month Secret

POS salespeople have monthly quotas. Last week of the month? They’ll cut prices to hit their numbers.

True story: A client waited until month-end and got 40% off just by timing his purchase right.

How to Apply for a POS Machine Without Getting Rejected

Let’s talk about something nobody wants to discuss: POS application rejections. They happen more than you think.

Why Applications Get Rejected (The Real Reasons)

Official reasons they give:

- “Insufficient credit history”

- “Unable to verify business”

- “High-risk industry”

Real reasons (what they don’t say):

- Your business looks too new/unstable

- They found negative reviews about your business online

- Your bank account shows irregular deposits

- You applied right after another rejection (yes, they check this)

“POS applications are like dating apps. Everyone’s judging you based on limited information, and rejection hurts your chances with the next company.” – Jennifer Walsh, Payment Processing Consultant

The Smart Application Strategy

Here’s the controversial truth: Don’t apply to your first choice first. Practice on the companies you don’t want.

Application order:

- Apply to your 3rd choice (practice round)

- Apply to your 2nd choice (if #1 rejects you)

- Apply to your top choice (when you’re ready)

Why? Each rejection makes the next one more likely. Start with backup options.

Documents That Actually Matter

Forget what they tell you. Here’s what really influences approval:

Most important:

- 6 months of bank statements (showing steady deposits)

- Business license (recent and valid)

- Photo ID (current address matching business)

Less important than they claim:

- Business plans

- Tax returns

- References

The 48-Hour Rule

Most POS companies make decisions within 48 hours. If you don’t hear back in 3 days, you’re probably rejected. Start applying elsewhere.

Where Can I Buy POS Machine Without Getting Scammed

Time for some truth about POS scams. Yes, they exist, and they’re getting smarter.

Common POS Scams to Avoid

The “Free Equipment” Scam: They give you “free” equipment but lock you into 5-year contracts with crazy fees.

The “Rate Increase” Scam: They quote low rates, then increase them after 6 months. Fine print allows it.

Red Flags When Shopping

Run away if they:

- Won’t give you written quotes

- Pressure you to sign immediately

- Quote rates without seeing your business

- Want money upfront before equipment delivery

- Can’t explain their fee structure clearly

Legitimate Places to Buy POS Machine

Safest options:

- Direct from a manufacturers like Square, Clover, etc.

- Major retailers like Amazon, Best Buy & Costco

- Established payment processors (with good reviews)

- Local dealers (with physical locations you can visit)

Riskiest options:

- Door to door sales people

- Cold callers

- Online ads with “limited time offers”

- Companies you’ve never heard of

Advanced POS Selection: Beyond Basic Features

Most guides tell you about basic features. Let’s talk about advanced stuff that actually matters.

Integration Capabilities (The Game Changer)

Your POS should talk to your other business systems. If it doesn’t, you’ll waste hours on manual work.

Essential integrations:

- Accounting software

- E-commerce platforms

- Inventory management systems

- Employee scheduling tools

- Marketing platforms

The Cloud vs Local Debate

Cloud-based POS (data stored online):

- Pros: Access from anywhere, automatic updates, disaster recovery

- Cons: Need internet, monthly fees, data security concerns

Local POS (data stored on your computer):

- Pros: Works without internet, one-time cost, full data control

- Cons: No remote access, manual updates, hardware dependence

Controversial opinion: Cloud win for 90% of businesses. The convenience outweighs the risk.

Multi-Location Management

Planning to expand? This feature can make or break your growth.

What to look for:

- Centralized reporting (see all locations at once)

- Inventory transfer between locations

- Employee management across sites

- Unified customer database

Cost reality: Multi location features adds $30 to 100 per location per month.

Industry-Specific POS Requirements

Different businesses needs different things. Here is what matters for each industry.

Restaurant POS System Deep Dive

Restaurants are the most complex businesses for POS systems. Here’s why:

Unique challenges:

- Multiple revenue streams like dine in, takeout & delivery

- Complex menu modifications

- Split checks and shared tabs

- Tip management and pooling

- Kitchen display integration

- Inventory with expiration dates

Modern restaurant trend: Integration with food ordering system platforms. Customers order online, orders flow into your POS, kitchen gets tickets automatically.

Cost reality: Good restaurant POS systems cost 2-3x more than retail systems.

Retail POS Essentials

Retail seems simple but has hidden complexities:

Inventory challenges:

- Multiple suppliers and SKUs

- Seasonal inventory changes

- Size/color variants

- Return management

- Multi-location stock transfers

E-commerce integration: Your online store and physical store inventory must sync. If they don’t, you’ll oversell and anger customers.

Service Business POS (Often Overlooked)

Salons, auto repair, consultants – these businesses have unique needs:

Service-specific features:

- Appointment scheduling

- Service time tracking

- Customer notes/history

- Recurring billing

- Service packages

Truth: Most service businesses use retail POS systems and struggle. Get industry-specific software.

How to Get POS Setup Right the First Time

Setup is where most businesses fail. They rush through it and pay the price later.

Pre-Setup Checklist

Before your POS arrives:

- Map out your workflow

- List all products/services with prices

- Identify staff roles and permissions

- Plan your receipt layout

- Choose your payment methods

- Set up your business accounts

The First Week Strategy

Day 1-2: Hardware setup & basic configuration

Day 3-4: Enter all product & test transaction

Day 5-6: Train staff on the basic operations

Day 7: Go live with backup plan ready

Critical mistake: Going live without a proper testing. Always run parallel with your old system for at least one week.

Staff Training (The Make-or-Break Factor)

Your POS is only as good as the people using it. Poor training costs money.

Training priorities:

- Basic transactions (80% of usage)

- Returns and exchanges

- Discount applications

- End-of-day procedures

- Basic troubleshooting

Training time needed:

- Basic staff: 2-4 hours

- Managers: 8-12 hours

- Owners: 20+ hours (to understand reporting)

Maintenance and Support: The Ongoing Reality

Nobody talks about POS maintenance. Here’s what you need to know.

Support Tiers and What They Really Mean

Basic support (usually included):

- Phone support during business hours

- Email support (24-48 hour response)

- Online knowledge base

Premium support ($30-100/month extra):

- 24/7 phone support

- Remote troubleshooting

- Priority response

- Dedicated account manager

Truth: You will need premium support in your first year. Make a budget for it.

Common Problems & Solutions

Top 5 POS problems:

- Slow processing (usually internet issue)

- Connection errors (network/ISP problems)

- Receipt printer jams (use quality paper)

- Screen freezes (restart fixes 80% of issues)

- Card reader errors (clean regularly)

The Backup Plan Nobody Thinks About

What happens when your POS dies during your busiest day?

Essential backups:

- Manual credit card machine (for card payments)

- Calculator and receipt book (for cash sales)

- Phone number for your processor (to report problems)

- List of key product prices (memory backup)

Real story: Lisa’s bakery POS died on Valentine’s Day. No backup plan. She lost $3,000 in sales because she couldn’t process cards.

Future-Proofing Your POS Investment

Technology changes fast. Your POS choice today affects your business for years.

Emerging Payment Technologies

What’s coming:

- Cryptocurrency payments (already here in some areas)

- Voice-activated payments

- Biometric payments (fingerprint, facial recognition)

- Augmented reality shopping integration

What to look for: POS systems that update regularly and embrace new payment methods.

The Mobile-First Future

More customers expect to pay with phones. Make sure your POS handles:

- Apple Pay and Google Pay

- QR code payments

- Buy now, pay later options

- Digital wallets

Sustainability and Green POS

Controversial opinion: Paper receipts are dying. Customers want digital receipts.

Benefits of digital receipts:

- Lower costs (no paper/ink)

- Better for environment

- Easier customer tracking

- Reduced storage needs

Resistance: Older customers still want paper. Plan for both.

The Final Decision: Choosing Your POS Provider

After everything we’ve covered, here’s how to make the final choice.

The Final Test Questions

Before signing anything, ask:

- “What’s my total cost for 3 years, including all fees?”

- “Can I cancel anytime without penalty?”

- “What happens if I outgrow this system?”

- “Who do I call at 2 AM if something breaks?”

- “Can you show me 3 similar businesses using this system?”

If they can’t answer clearly, keep looking.

Contract Negotiation Tips

Always negotiate:

- Monthly fees (ask for 6-month discount)

- Setup fees (often waived)

- Early termination penalties

- Rate lock periods

- Equipment upgrade terms

Never accept:

- Automatic renewal clauses

- Rate increase permissions

- Long term contract over two years

- Exclusive processing agreements

Success Stories and Horror Stories

Success Story: The Smart Coffee Shop

Mike’s coffee shop in Portland did everything right:

- Researched for 2 months before buying

- Got quotes from 5 providers

- Negotiated rates and fees

- Chose system that integrated with his QR code ordering system

- Trained staff properly

Result: Saved $2,400 in first year compared to his first quote.

Horror Story: The Rushed Restaurant

Sarah’s restaurant needed a POS “immediately” after their old system died:

- Bought first system they found

- Signed 5-year contract without reading

- No staff training

- No backup plan

Result: $15,000 in extra costs, constant problems, angry customers.

Lesson: Rushing cost money. So, always have a backup plan.

Final Recommendations

After 15 years in this industry, here’s my honest advice:

For Small Businesses (Under $200k annual sale)

Best choice: Foodship (growing fast, good value) or similar simple system

Why: Easy to use, transparent pricing & good support

Avoid: Complex enterprise systems & long contracts

For Growing Businesses ($200k to $1M annual sale)

Best choice: Mid-tier systems with growth features

Consider: Square for restaurants

Focus on: Integration capabilities, multi-location support

For Large Businesses (Over $1M annual sale)

Best choice: Enterprise system with custom features

Priority: Dedicated support, advanced reporting & scalability

Budget: $5,000 to 10,000 annually for POS cost

Universal Advice

- Never rush the decision

- Calculate 3-year costs, not just upfront

- Test before committing

- Read contracts carefully

- Plan for growth

“The best POS system is the one that grows with your business and doesn’t surprise you with hidden costs.” – Amanda Torres, Business Operations Expert

Conclusion

Getting a POS machine doesn’t have to be complicated or expensive. The key is knowing what questions to ask and what traps to avoid.

Remember:

- Hardware costs are just the beginning

- Monthly fees add up fast

- Processing rates matter more than equipment prices

- Support quality can make or break your business

- Contract terms affect your flexibility

Take your time. Do your research. Calculate the real costs. And never, ever sign anything you don’t understand completely.

Your business deserves POS system that helps you grow. It shouldn’t be the one that holds you back with hidden fees & poor support.

Ready to get started?

Use this guide as your roadmap & remember the cheapest option isn’t always the best but the most expensive isn’t always necessary either.

Find sweet spot that works for your business, your budget & your growth plans. Good luck!

Need help choosing right POS system for your specific business?

The key is matching your actual needs with the right solution – not the most expensive one or the cheapest one, but the right one.